What kind of owner are you? How does that impact your transition choices?

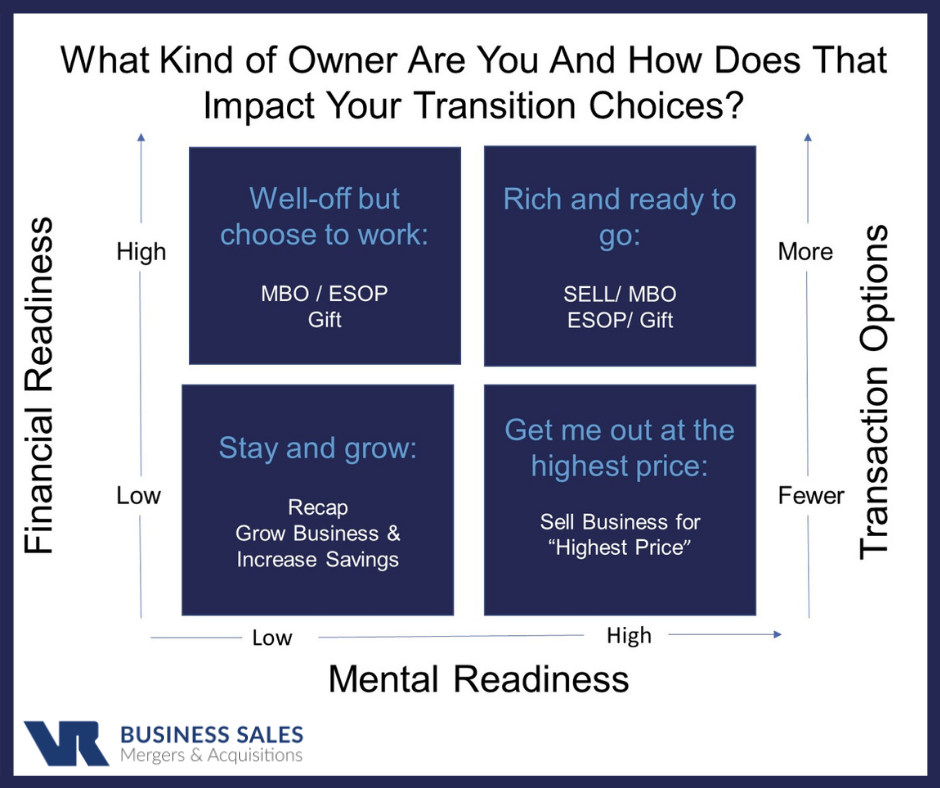

Owners that are approaching a time when they wish to exit their business need to undertake a realistic appraisal of how ready they are financially and mentally. The options that are available to them depend upon the results from this assessment. Over the years, our firm has used a matrix to help define these options.

The axes of the matrix lead from low to high for mental and financial readiness. High financial readiness suggests the owner has created enough value and/or sufficiently saved funds for retirement so that after an exit they will achieve financial security. High mental readiness suggests that they are burned out or ready to enter retirement fully. Low financial and mental readiness is the exact opposite.

Where owners are on the matrix will dictate their exit options. For example, if they are neither mentally nor financially ready, and have a continued desire to grow the business, but are not well capitalized to do so, then they may want to consider taking on a partner to recapitalize it. Private Equity Groups are quite keen to do this. Alternatively, if owners are financially ready to exit but still wish to work, one option is to create a gradual exit by gifting the business to the next generation or selling to existing management over time. The worst position for an owner is to be mentally ready but unprepared financially.

Owner Motivations

To assess your mental and financial readiness, taking a self-assessment is important. Answering the questions below will indicate how ready you are mentally and financially.

Questions to Ask:

- How old are you?

- Do you have any health issues?

- What is your personal financial situation like?

- Do you have sufficient funds to retire independent of those funds derived from selling the business?

- What is the value of the business as a percentage of your net worth?

- Do you have a life plan in place post sale?

- Do you wish to pass on the business to your family or employees?

- Do you have a passion to continue running the business?

- Do you wish to grow the business?

- Do you have shareholders? If yes, what are their rights in a sale?

- How important are your employees in making a decision to sell?

- Is it important to reduce your risk?

If you’d like to discuss how these questions play into your exit strategy and transition choices, please feel free to call us to discuss. We are also happy to provide a no charge, no obligation, opinion of value that defines our view on the current business valuation and the terms under which it would be sold. Doing this is the most important first step an owner can take to address the issues with business exit planning.