Welcome to our “How to Sell” series with industry-specific information on how companies are valued and key factors affecting final sale price.

View and print valuation guide: Printing & Graphics Value Advisor

Industry Definition

This guidance relates to commercial printers who produce a wide range of products from paper based products, such as brochures, stationery and magazines, to signs and promotional products. Companies in this sector are increasingly offering a variety of output formats, including digital printing, as well as in-house graphic design.

Key Valuation Considerations

- Management Team: The printing industry is mature with overcapacity and only slight growth. A strong management team is crucial to company success, where revenues per employee is an important indicator. An appealing company will have at least $180,000 in revenues per employee depending on the size and type of company. Person to person relationships are critical for customer retention and acquisition.

- Customer Retention & Concentration: Retention is a big factor in this sector, from subscribers to advertisers to corporate clients. Operating within a highly competitive industry, profitability of printing companies is correlated with retention capabilities. A company with high retention rates and long-term contracts bodes well and can demand higher multiples, so long as key relationships aren’t a result of personal ties with the owner. Customer concentration is a major concern for buyers, who want to see that no one customer accounts for more than about 10% of sales.

- Design Competencies: In order to remain competitive, printing companies have been increasingly expanding services into promotional items, large signs and in-house graphic design. Graphic design capabilities, including necessary design software and staff, helps to increase sale price as it allows the company to capture more wallet share from clients. These one-stop shops are becoming increasingly popular.

- Equipment & Software: Modern equipment decreases production time and cost, while improving employee productivity. Emerging technologies have rapidly expanded consumption and delivery vehicle options. Printing companies with a wide array of digital formats and delivery capabilities will improve company salability. Up-to-date software and equipment are important. If companies haven’t made necessary investments, buyers will conclude that additional CapEx investments are required, which will depress valuations.

- Other Important Considerations:

- Value Added Services

- Exclusive Relationships

- Local/Regional Market Share

- Reputation

- Industries Served

- Geographical Concentration

These are only a few variables. A professional valuation is strongly recommended for accuracy. Contact us for a simple, free valuation today or for information on our full suite of valuation services.

Footnotes

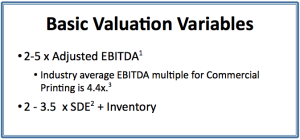

1 Adjusted EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization where the EBITDA is adjusted for unusual expenses and compensation, then normalized to align with market based benefits and compensation required to operate the business.

2 SDE: Seller’s Discretionary Earnings is EBITDA plus all owner compensation and benefits.

3 Based upon statistics from M&A Source, First Research reports stating average Market Value of Invested Capital/EBITDA is 4.4 for Commercial Printing (1-18-16).